Upper Tamakoshi issuing 100% right shares from 18th of Bhadra

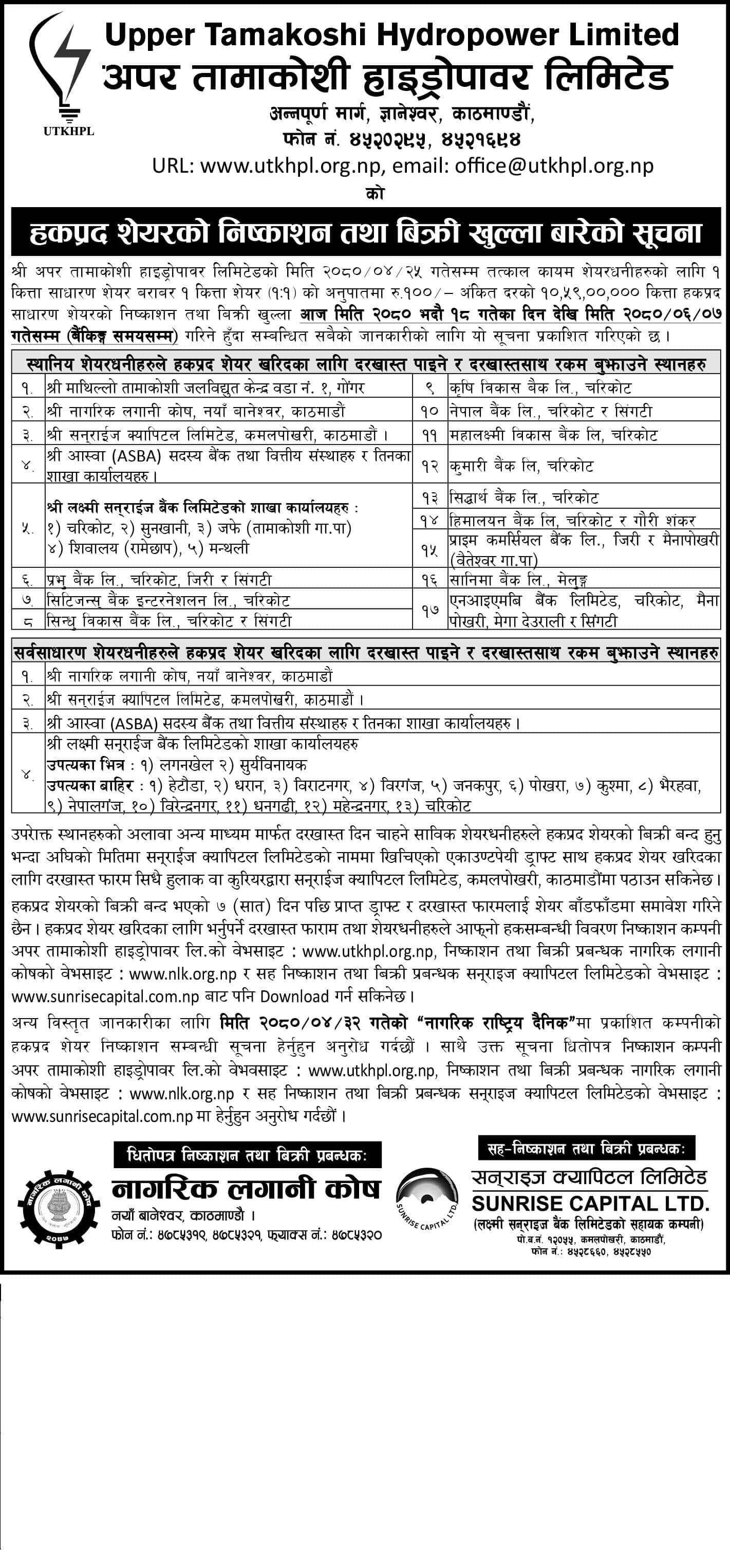

The company had closed its books on Shrawan 26 for the purpose of issue of rights shares. According to this, until 25th of Shrawan, shareholders who have been transacted in NEPSE can apply for the right shares. You can apply for the right shares of the company till Aswin 7th.

Upper Tamakoshi Hydropower Limited is going to open the issue and sale of right shares from 18th of Bhadra. Currently, the company is about to issue 100 percent of its paid-up capital i.e. 100 percent right shares.

That is, the company is currently going to issue 1 new share equal to 1 share. According to this, the company will issue 10 million 59 million right shares with a face value of 100 rupees per share worth 10.59 billion rupees.

The company had closed its books on Shrawan 26 for the purpose of issue of rights shares. According to this, until 25th of Shrawan, shareholders who have been transacted in NEPSE can apply for the right shares. You can apply for the right shares of the company till Aswin 7th.

Care Rating Nepal has given CareNP Issuer Rating Double B to the company in the rating given for the rights issue. This indicates that there is moderate risk in the ability to meet financial obligations on time.

Citizen Investment Fund is the issuing and selling manager of the company, while Sunrise Capital Limited is the co-selling manager. Investors can visit Upper Tamakoshi Hydropower Center, Citizens Investment Fund, Sunrise Capital, Lakshmi Sunrise Bank, Prabhu Bank, Citizens Bank, Sindhu Development Bank, Krishi Development Bank, Nepal Bank, Mahalakshmi Development Bank, Kumari Bank, Siddharth Bank, Himalayan Bank, Prime Commercial Bank And they can apply from the designated branch offices of Sanima Bank. Apart from this, applications can also be made from banks and financial institutions participating in the ASWA service after taking permission from the Nepal Securities Board.

Currently, the paid up capital of the company is 10.59 billion rupees. After the rights issue and distribution, the company's paid-up capital will reach 21.18 billion rupees.

It has been decided to issue rights shares as it is necessary to manage the finances for the entire Rolwaling diversion scheme including the 20.66 megawatt capacity Rolwaling river hydroelectric project that the company will construct in the second phase. In addition to this, due to various reasons, the construction period and cost have increased and since the increased cost has been covered only by loans, there is currently a deep difference in the ratio of debt to equity capital, and the interest expense will increase due to the increasing dependence on debt, and the company is not going to issue rights shares in the future. yes