Sarbottam Cement to issue IPO for Locals and Nepalese Employed Abroad

Sarbottam Cement Limited has published an offer to issue an Initial Public Offering (IPO) to the locals of Nawalparasi District, mine excavation-affected locals of Palpa District, and Nepalese Employed Abroad.

Sarbottam Cement, part of Saurabh Group was founded in the year 2010, however, it came into operation in February 2014. Its head office is at Neupane Tower, Tinkune, Kathmandu with the factory situated approximately 240 km away from Kathmandu at Sunwal, Nawalparasi. The factory has been established with an authorized capital of Rs 4,000 million. It is one of the largest cement factories in Nepal that produces its clinker. The factory is spread over 30 bighas of land and the mine is spread over an area of 20 square kilometers for extracting limestone. At present, Sarbottam Cement employs 200+ people all across Nepal.

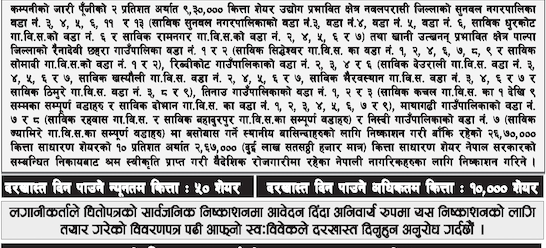

The IPO is available for people living in Nawalparasi District, those affected by mine excavation in Palpa District, and foreign Nepalese immigrants from 25th Poush to 10th Magh, 2080. If the locals impacted by the industry in Nawalparasi or mine excavation in Palpa don't subscribe by the initial deadline, the offering will be extended until January 25th. However, this extension won't apply to foreign Nepalese immigrants—they need to subscribe by the initial deadline.

Earlier, as per the guidelines, the cement company had issued its primary shares through the book-building process to the Qualified Institutional Investors (QII) from 6th - 10th Mangsir, 2080. The allotment of which happened on 11th Mangsir. A total of 41 eligible institutional investors had applied for 36,19,190 unit shares against 24 Lakh units initially offered to them.

Sarbottam Cement is to issue 12.9033% of its capital, which amounts to Rs 4.65 Arba (4.65 billion rupees), totaling 60 lakh shares or 60 crore rupees. Of these, 40% (24 lakh shares) are already allotted to Qualified Institutional Investors (QIIs), and the remaining 60% (36 lakh shares) are for the public.

Out of the 36 lakh shares, 9,30,000 shares will go to locals affected by industry in Nawalparasi District or mining in Palpa District. The rest, 26,70,000 shares, will be divided further: 10% (2,67,000 shares) for Nepalese citizens working abroad and the remaining 24,03,000 shares for the general public to apply for.

Applicants can apply for a minimum of 50 units while the maximum quantity is 10,000. The share price of the company is Rs. 360.90 per share for public investors. The company is issuing an IPO through the book-building method. ICRA Nepal has reaffirmed the issuer rating of [ICRANP-IR] BBB+ (pronounced ICRA NP issuer rating triple B plus) to Sarbottam Cement Limited. ICRA Nepal has also reaffirmed the long-term rating of [ICRANP] LBBB+ (pronounced ICRA NP L triple B plus) and the short-term rating of [ICRANP] A2 (pronounced ICRA NP A two) to Sarbottam’s bank loan limits. Global IME Capital is appointed as the issue manager.

Also Read: Opening Price Range of Sarbottam Cement Limited ?