Nepal Rastra bank revises share loan from 12 crore to 15 crore. How much for institutional?

Kathmandu. The share loan limit has been revised from 12 crores to 15 crores for individual shareholders. The Nepal Rastra Bank (NRB) has stated this in the revised unified directive it has issued.

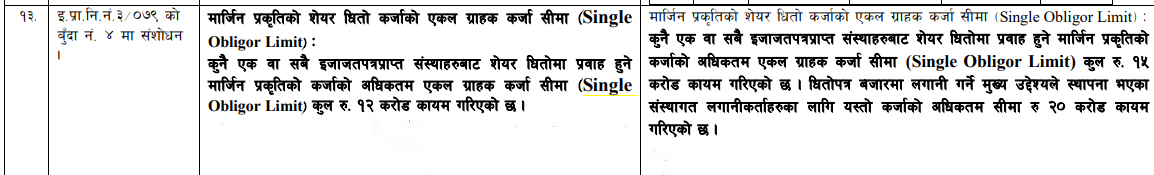

According to the Nepal Rastra Bank, the maximum Single Obligor Limit (SOL) for share loans, which allows individuals or institutions with approved permits to lend in the stock market, has been increased from 12 crores to 15 crores NPR.

Similarly, for institutional investors established with the primary objective of investing in the stock market, the maximum loan limit for share loans has been increased to 20 crores NPR.

As a result of the revision in the share loan limit, investors have expressed mixed reactions. Some have welcomed it as a positive step, while others have criticized it as a mere formality. With the implementation of the share loan revision by the Rastra Bank, it is certain that the flow of share loans from banks will increase. However, it remains to be seen how the share market reacts to the Rastra Bank's revised policy.

In the past few days, the market seemed volatile as different economic media portals reported that the limit is going to be revised but Rastra Bank remained silent. Finally the limit has been revised, but this may not positively affect the market since the difference is not much noticeable.