NEPSE Market Summary for 2023-09-26

Today on the Nepal Stock Exchange (NEPSE), we'll take a closer look at the top 5 sectors, brokers, gainers and losers . Let's see how they did in this market summary.

NEPSE Summary

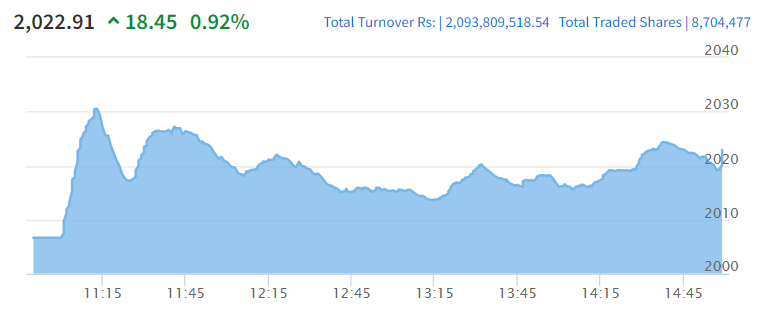

In the latest update, NEPSE closed at 2022.91 points, with a high of 2030.51 and a low of 2005.42 during the trading session. Compared to the previous close of 2004.45, it saw a modest gain of 18.45 points, reflecting a positive change of 0.92%. This data indicates a relatively stable market with a slight upward trend, suggesting optimism among investors in the Nepalese stock market.

Sectors Summary

| Sector | Current | Daily Gain | Turn Over | Negative Stocks | Positive Stocks |

|---|---|---|---|---|---|

| BANKING | 1260.45 | 0.16% | 289726904.2 | 10 | 9 |

| TRADING | 2961.72 | 0.0% | 18203486.2 | 1 | 1 |

| HOTELS | 5441.15 | -0.18% | 53453092.3 | 2 | 4 |

| DEVBANK | 3872.36 | 0.51% | 94085068.7 | 6 | 10 |

| HYDROPOWER | 2223.58 | 3.09% | 742146183.7 | 3 | 80 |

| FINANCE | 1785.99 | 1.44% | 57827219.3 | 1 | 14 |

| NONLIFEINSU | 10612.92 | 0.56% | 120404888.5 | 2 | 10 |

| MANUFACTURE | 5281.36 | 0.38% | 121118797.1 | 1 | 3 |

| OTHERS | 1473.86 | 0.85% | 35337752.0 | 0 | 3 |

| MICROFINANCE | 3721.0 | 1.17% | 159948639.9 | 12 | 42 |

| LIFEINSU | 10847.23 | 1.25% | 248991908.0 | 0 | 9 |

| INVESTMENT | 69.98 | 1.11% | 95092296.5 | 1 | 5 |

In the banking sector, the current price is Rs 1260.45 with a daily gain of 0.16%. The turnover is at an impressive 289,726,904.2. There are 10 negative stocks and 9 positive stocks. In the trading sector, the current price is Rs 2961.72 with no daily gain. The turnover is at Rs 18,203,486.2. There is only one negative stock and one positive stock. In the hotels sector, the current price is Rs 5441.15 with a daily loss of 0.18%. The turnover is at a significant 53,453,092.3. There are 2 negative stocks and 4 positive stocks. In the development bank sector, the current price is Rs 3872.36 with a daily gain of 0.51%. The turnover is at a high Rs 94,085,068.7. There are 6 negative stocks and 10 positive stocks. In the hydropower sector, the current price is Rs 2223.58 with a significant daily gain of 3.09%. The turnover is at a staggering 742,1461,83.7. There are 3 negative stocks and 80 positive stocks and so on.

Brokers Summary

| Broker Number | Tot. Purchase Amount | Tot. Sell Amount | Tot. Turnover | Total Turnover Share |

|---|---|---|---|---|

| 58 | 100821519.44 | 105195138.39 | 206016657.83 | 9.84% |

| 45 | 121673115.3 | 78173652.18 | 199846767.48 | 9.54% |

| 49 | 89289248.8 | 79688471.49 | 168977720.29 | 8.07% |

| 34 | 87894062.82 | 58028229.5 | 145922292.32 | 6.97% |

| 6 | 47602164.6 | 97372651.55 | 144974816.15 | 6.92% |

Broker number 58 had a total purchase amount of Rs 100,821,519.44 and a total sell amount of Rs 105,195,138.39, resulting in a total turnover of Rs 206,016,657.83, representing 9.84% of the total turnover share. Similarly, broker number 45 had a purchase amount of Rs 121,673,115.30 and a sell amount of Rs 78,173,652.18, resulting in a total turnover of Rs 199,846,767.48, representing 9.54% of the total turnover share. Broker number 49 had a purchase amount of Rs 89,289,248.80 and a sell amount of Rs 79,688,471.49, resulting in a total turnover of Rs 168,977,720.29, representing 8.07% of the total turnover share. Broker number 34 had a purchase amount of Rs 87,894,062.82 and a sell amount of Rs 58,028,229.50, resulting in a total turnover of Rs 145,922,292.32, representing 6.97% of the total turnover share. Finally, broker number 6 had a purchase amount of Rs 47,602,164.60 and a sell amount of Rs 97,372,651.55, resulting in a total turnover of Rs 144,974,816.15, representing 6.92% of the total turnover share.

Intraday Gainers Summary

| Symbol | Sector | LTP | Intraday Gain | Volume |

|---|---|---|---|---|

| SPL | Hydro Power | 935.5 | 12.24% | 19277 |

| SMFBS | Microfinance | 1174.0 | 11.81% | 613 |

| MHCL | Hydro Power | 213.1 | 10.41% | 61900 |

| GIBF1 | Mutual Fund | 8.95 | 10.09% | 183425 |

| MEHL | Hydro Power | 247.5 | 10.0% | 62839 |

SPL, a company in the hydropower sector, had a last traded price (LTP) of Rs 935.5, with a daily change of 9.99% and a trading volume of 19,277 shares. SMFBS, a microfinance company, saw its LTP at Rs 1174.0, with a daily change of 9.93%, and a trading volume of 613 shares. MHCL, another hydropower company, had an LTP of Rs 213.1, with a daily change of 9.96%, and a trading volume of 61,900 shares. GIBF1, a mutual fund, had a price of Rs 8.95, with a daily change of 7.96%, and a trading volume of 183,425 shares. Lastly, MEHL, a company in the hydropower sector, had an LTP of Rs 247.5, with a daily change of 10.0%, and a trading volume of 62,839 shares.

Intraday Losers Summary

| Symbol | Sector | LTP | Intraday Change | Volume |

|---|---|---|---|---|

| BBC | Tradings | 3851.0 | -4.28% | 285 |

| HLBSL | Microfinance | 706.0 | -3.95% | 6062 |

| SIGS2 | Mutual Fund | 8.17 | -3.88% | 405 |

| KLBSL | Microfinance | 742.8 | -3.66% | 1315 |

| TSHL | Hydro Power | 419.0 | -3.66% | 43195 |

The BBC in the trading sector saw its price decrease by 2.38% to Rs 3851.0 with a volume of 285. HLBSL, a microfinance company, experienced a bigger drop of 5.87% to Rs 706.0 with a volume of 6062. SIGS2, a mutual fund, also declined by 2.39% to Rs 8.17 with a volume of 405. KLBSL, another microfinance company, had a smaller decrease of 1.99% to Rs 742.8 with a volume of 1315. TSHL, a hydro power company, faced a significant decline of 5.57% to Rs 419.0 with a volume of 43195.

Top Gainers Summary

| Symbol | Sector | LTP | Daily Change | Volume |

|---|---|---|---|---|

| MCHL | Hydro Power | 283.8 | 10.0% | 60611 |

| MEHL | Hydro Power | 247.5 | 10.0% | 62839 |

| SPL | Hydro Power | 935.5 | 9.99% | 19277 |

| MHCL | Hydro Power | 213.1 | 9.96% | 61900 |

| SMFBS | Microfinance | 1174.0 | 9.93% | 613 |

MCHL, a hydropower company, saw a rise of 10.0% in its share price, now at Rs 283.8, with a trading volume of 60611. Similarly, MEHL's shares also increased by 10.0%, reaching Rs 247.5, with a volume of 62839. SPL, another hydropower company, experienced a 9.99% price surge to Rs 935.5, with a trading volume of 19277. MHCL's hydropower shares rose by 9.96% to Rs 213.1, with a trading volume of 61900. Lastly, SMFBS, a company in the microfinance sector, witnessed a 9.93% rise in its share price, now at Rs 1174.0, with a lower trading volume of 613.

Top Losers Summary

| Symbol | Sector | LTP | Daily Change | Volume |

|---|---|---|---|---|

| HLBSL | Microfinance | 706.0 | -5.87% | 6062 |

| TSHL | Hydro Power | 419.0 | -5.57% | 43195 |

| LVF2 | Mutual Fund | 9.62 | -3.8% | 200 |

| NIMBPO | - | 150.2 | -3.53% | 4349 |

| GMFBS | Microfinance | 717.0 | -3.11% | 172 |

The HLBSL microfinance sector had a last traded price (LTP) of Rs 706.0, with a daily change of -5.87% and a total volume of 6062 shares. The TSHL hydropower sector had an LTP of Rs 419.0, with a daily change of -5.57% and a volume of 43195 shares. The LVF2 mutual fund sector had an LTP of Rs 9.62, with a daily change of -3.8% and a volume of 200 shares. The NIMBPO sector had an LTP of Rs 150.2, a daily change of -3.53%, and a volume of 4349 shares. The GMFBS microfinance sector had an LTP of Rs 717.0, a daily change of -3.11%, and a volume of 172 shares.

Top Turnovers Summary

| Symbol | Sector | LTP | Daily Change | Volume |

|---|---|---|---|---|

| NICA | Commercial Banks | 788.6 | -0.43% | 106020 |

| SNLI | Life Insurance | 478.1 | 4.16% | 160361 |

| RNLI | Life Insurance | 477.7 | 3.85% | 151068 |

| SHIVM | Manufacturing And Processing | 556.0 | 3.15% | 125867 |

| HDHPC | Hydro Power | 138.9 | 4.51% | 414850 |

The NICA in the Commercial Banks sector had a last traded price (LTP) of Rs 788.6, with a daily change of -0.43% and a trading volume of 106,020. In the Life Insurance sector, the SNLI symbol had an LTP of Rs 478.1, with a daily change of 4.16% and a trading volume of 160,361. Similarly, the RNLI, also in the Life Insurance sector had an LTP of Rs 477.7, with a daily change of 3.85% and a trading volume of 151,068. In the Manufacturing and Processing sector, the SHIVM had an LTP of Rs 556.0, with a daily change of 3.15% and a trading volume of 125,867. Lastly, the HDHPC in the Hydro Power sector had an LTP of Rs 138.9, with a daily change of 4.51% and a trading volume of 414,850.