Everest Bank announces its dividend, 50% less than expected?

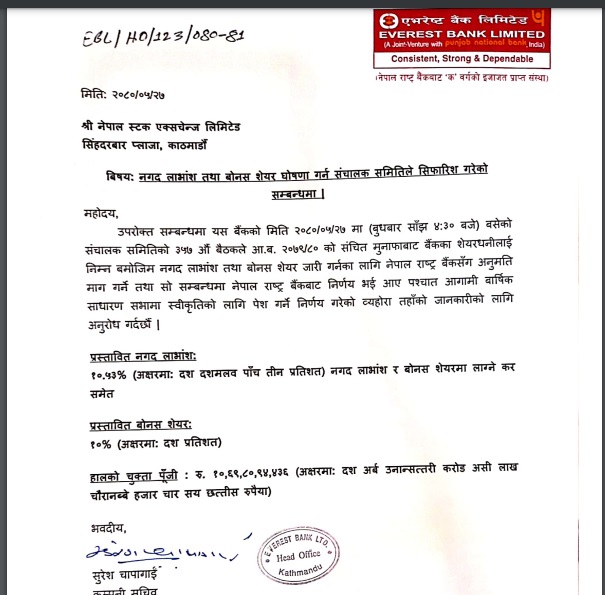

Everest Bank has declared a 20.53% (10.53% cash and 10% bonus share) dividend distribution from the accumulated profits of the fiscal year 2079/80.

In a recent meeting convened by the Board of Directors of Everest Bank, significant decisions regarding the distribution of profits for the fiscal year 2079/80 were made. The outcome of this meeting has left shareholders eagerly anticipating their returns. Let's dive into the details of this dividend announcement.

Everest Bank has declared a 20.53% (10.53% cash and 10% bonus share) dividend distribution from the accumulated profits of the fiscal year 2079/80. This news brings good tidings for the bank's shareholders, who will be receiving a portion of these profits. However, the bank's generosity doesn't stop there.

In addition to the cash dividend of 10.53%, Everest Bank has decided to reward its shareholders with a bonus of 10%. This means that shareholders will not only receive a portion of the profits in cash but also receive additional shares as a bonus.

It's worth noting that even with a profit retention capacity of 40%, Everest Bank has opted to declare a dividend of 20.53%. This decision underscores the bank's commitment to rewarding its shareholders while maintaining a healthy balance between retaining funds for growth and distributing profits to investors.

The next step in this process involves approval from the central regulatory authority, the Nepal Rastra Bank. Once this approval is obtained, investors can expect to receive their dividends. This is great news for shareholders, as it allows them to reap the benefits of their investment in Everest Bank.

Comparing this year's dividend distribution with the previous fiscal year, we can see a substantial decrease in shareholder rewards. In the previous fiscal year, the bank distributed a total of 20.68% in dividends, comprising a 13% bonus share and 7.68% cash dividend. This year's announcement of 20.53% in dividends demonstrates Everest Bank's continued commitment to its shareholders. Bank has a total capital of Rs 10 Arab 67 crore 80 lakhs.

Dividend history of Everest bank:

| S.N | Bonus Shares(%) | Cash(%) | Total(%) | Announcement Date | Fiscal Year |

| 1 | 10.00 | 10.53 | 20.53 | 2023-09-13 | 2079/2080 |

| 2 | 13.00 | 7.68 | 20.68 | 2022-11-06 | 2078/2079 |

| 3 | 6.00 | 4.32 | 10.32 | 2021-10-29 | 2077/2078 |

| 4 | 5.00 | 5.53 | 10.53 | 2020-11-05 | 2076/2077 |

| 5 | 5.00 | 20.00 | 25.00 | 2020-07-29 | 2075/2076 |

| 6 | 0.00 | 20.00 | 20.00 | 2018-12-02 | 2074/2075 |

| 7 | 33.00 | 1.74 | 34.74 | 2073/2074 | |

| 8 | 70.00 | 3.675 | 73.675 | 2072/2073 | |

| 9 | 30.00 | 6.57 | 36.57 | 2071/2072 | |

| 10 | 12.00 | 50.00 | 62.00 | 2070/2071 | |

| 11 | 10.00 | 50.53 | 60.53 | 2069/2070 | |

| 12 | 30.00 | 1.58 | 31.58 | 2068/2069 | |

| 13 | 10.00 | 50.00 | 60.00 | 2067/2068 |

In conclusion, Everest Bank's recent dividend announcement is a positive development for its shareholders. With a combination of cash dividends and bonus shares, investors can look forward to reaping the rewards of their investment in the bank. Pending regulatory approval, shareholders can anticipate receiving their dividends in the near future, marking another successful year for Everest Bank and its investors.